Liability Insurance

Aviation Product Liability Insurance: Hassle-Free Cover

Comprehensive coverage in minutes. Cut through complexity with rapid, aviation‑focused insurance.

Policy covers injury or property damage to third parties.

Protection if you supply or repair aircraft components.

Cover for liabilities for services you provide to third parties.

Protect people and property from injury or damage as a result of defective goods.

What Is It?

If you supply aircraft parts Aviation Product Liability Insurance covers your liability for goods and services that you have provided after they have left your care, custody, and control.

Exposure

General liability policies often exclude aviation related exposures and grounding liability. Small faults can result in big legal liabilities and costs.

Protection

As a manufacturer, designer, repair station or supplier, you have a duty of care to your customers. Protect your business from costly third party bodily injury and/or property damage claims.

Legal Requirement

To comply with your legal and contractual obligations speak to one of our product liability cover experts today.

Who Can Benefit

So who is aviation products liability insurance for?

Original Equipment Manufacturers (OEMs)

Parts Stockists

Aircraft Maintenance

Line Maintenance

Repair Station Operators (Part 145)

Distributors

MROs

Supply Chain

Liability Cover

Aviation Product Liability Insurance

Are you a manufacturer, distributor, or supplier of aviation products? Do you have the appropriate level of cover to fulfil your insurance needs?

You may have several questions related to product insurance, specifically aviation product liability insurance, such as:

What is product liability insurance?

Do I need product liability insurance?

How much product liability insurance do I need?

Is there specific insurance for aerospace manufacturers?

How much does product liability insurance cost?

We will address all these questions and more in order to provide you with the information you need to ensure your business is properly insured and ready to deal with any eventuality.

What is Aviation Product Liability Insurance?

Aviation product liability insurance is a specialised form of insurance designed to cover your liability for the services and goods you have provided after they have left your care and control.

General liability policies often exclude aviation-related exposure and grounding liability. This means that if you manufacture or supply aircraft parts and only have a General Liability policy, you could be leaving yourself exposed to significant legal liabilities and costs.

Get Covered — Bind and start selling with confidence:

Frequently Asked Questions About Aviation Liability

I already have liability insurance. Why do I need this?

That’s excellent. But how do you know you’re getting the best value? We have had instances where clients are insured through general insurers and policy wording excludes aviation components or practises. So, it costs you nothing for an independent expert to review your policy and requirements and give provide a current review. If you already have the best deal, then they will advise you to stay with it. But usually by shopping around at renewal you will get a better deal or the ability to bundle policies to enjoy a better dela overall.

How long does it take to get a quote?

Flycovr guarantees to connect you to an aviation expert in 60 minutes or less. This is the first phase of understanding what exactly you need and connecting you with the right regulated insurance partner to provide the advice that you need. All of this can be done within minutes. Typically, our clients are talking with an insurance partner within the hour or at least the same day in most cases. There are not many policies or provisions our team has not come across as we work with some of the most trusted and reputable insurance brokers and underwriters on the planet. Together, we will expedite the process minimise administration and get you a quote within hours.

I already have this as part of a larger policy. How difficult is it to switch over?

It’s simple. We do this all the time. Our trusted insurance partners. Having reviewed your specific. Requirements will usually request oversight of all your other insurance requirements. So that they can take everything into consideration when providing you the best liability quote. Often great deals can be found by bundling policies. And it’s very straightforward to switch over one or all your policies to our partners. We will see. We will support you throughout the whole process to ensure a seamless switch.

Liability Cover

Manufacturer Product Liability Insurance

As a manufacturer, designer, repair station, or supplier, you have a duty of care to your customers.

Manufacturer product insurance protects your business against claims made due to damage or injury caused by your products. It also covers legal fees or possible compensation arising from injury to a third party due to a faulty product.

This type of insurance is designed to cover liability for:

Cover

What Liability Can Be Covered?

01/

Property damage

02/

Injuries to a person or persons

03/

Associated compensation and legal costs

Who

Who Does it Protect?

01/

Manufacturers

02/

Distributors

03/

Sellers

03/

Retailers

If your company designed, made, distributed, or sold an aircraft part which subsequently caused property damage or injury to a person, then you could be facing costly legal action.

Get Covered — Bind and Start Selling With Confidence!

Even if your business only acts as a retailer, you could still be liable if a faulty product causes harm. Legal fees and damages can potentially bankrupt a business, so having the appropriate insurance is extremely important. Liability insurance can cover legal costs and compensation for the injured party.

To ensure you are fully compliant with your legal obligations, contact us and one of our product liability cover experts will be happy to help you.

Who Is Aviation Product Liability Insurance For?

Aviation product liability insurance exists to protect businesses in the aviation industry who might be liable for any injuries or damages caused by their products. If a claim is made, insurance can cover damages and legal expenses.

Having product liability insurance enables an aviation support company to do business. As their customers typically write the insurance as a requirement to sign the deal.

Get Covered — Bind and start selling with confidence:

So, Who Can Benefit from Aviation Product Liability Insurance?

Original Equipment Manufacturers (OEMs)

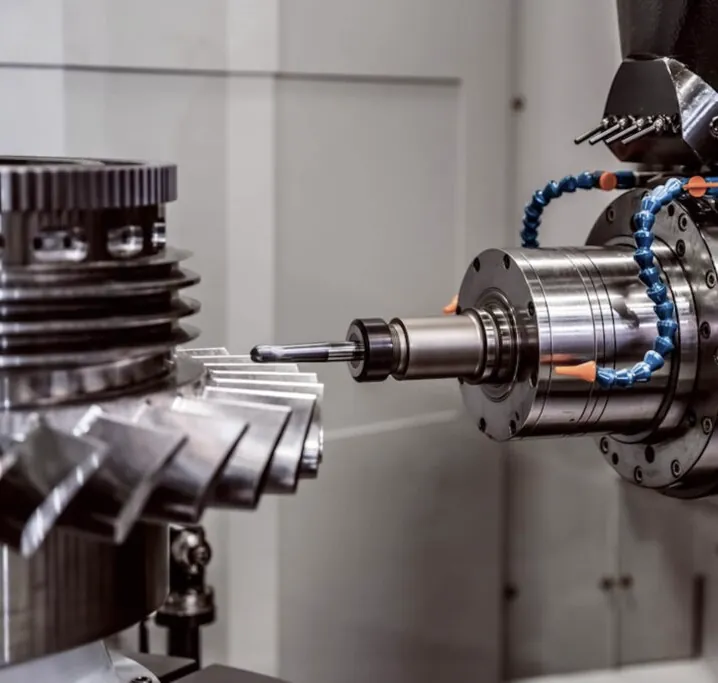

Manufacturers of airline parts can be liable for injuries or damage caused by a faulty product. Having the appropriate insurance is a must. This includes businesses which create aircraft engines, products and parts.

Maintenance and Repair Organisations (MROs)

Businesses which repair or maintain aircraft can be at risk of a potentially expensive claim for damages.

Ground crew

Companies which handle aircraft on the ground.

Designers

Companies or individuals who design aircraft, engines, spare parts, etc can also be liable for faulty equipment.

Supply Chain Entities

Suppliers of components, parts, and materials related to aviation. If you are part of the supply chain to the aviation industry, you need the correct insurance to protect your company.

Suppliers, Distributors, Retailers

Businesses who supply, sell, or distribute aircraft parts and materials related to the aviation industry.

Others

There is a wide range of companies involved in the aviation industry, including:

- Repair Stations and Repair Station Operators

- Stockists

- Aircraft and Line Maintenance

- Flight safety professionals

- Refuelling crews

And more. Aviation product liability insurance is a necessary part of doing business and the best way to protect yourself from a potentially catastrophic claim made against your company.

What Does Aviation Product Liability Insurance Cover / Not Cover?

Aviation product liability insurance is designed to offer protection against liability for property damage or physical injury caused by faulty aircraft parts or other problems related to the aviation industry.

Example

A manufacturer makes an aircraft engine which fails due to a fault – a third party can sue for any bodily injury or other damage caused by the defective part. Aviation product liability insurance will cover the claim, associated damages or compensation.

Things generally covered include:

Third-party physical injury

Damage to property

Defective products or materials

Grounding costs

Recall expenses

Things not typically included:

General wear and tear

Manufacturing defects not disclosed

Injuries to employees of the insured

Damage to property owned by the insurer

War or acts of terrorism

Nuclear incidents

Pollution

How Much Does Aviation Product Liability Insurance Cost?

Aviation product liability insurance costs vary based on various factors such as:

Amount of cover required

Do you require £500,000 or £10,000,000 coverage? Premiums will differ according to coverage limits.

Commercial or recreational usage

How the aircraft part is used and how risky the business is will affect pricing.

Complexity

Larger and more complex aircraft parts will typically mean higher premiums.

Claims history

A past history of claims made can mean higher premiums.

Cost Example

Your aviation product liability insurance will be highly personalised, and it’s always a good idea to compare product liability insurance, but as an example, your pricing could look something like this:

| Risk Profile | Starting Premium | Example |

| Drone manufacturer | $3,000 per year | Low volume, no exports |

| Aircraft engine parts sales | $15,000 per year | FAA certified, global exports |

For an individualised product liability insurance quote, get in touch, and our expert team will be happy to help and answer all of your questions.

Talk to an Aviation Expert within 60 mins

Access Global A-rated Products

No fuss, no obligation quotes

Global Support

Why Choose Flycovr for your Aviation Product Liability Insurance?

We are experts in Global Aviation Supply Chain Insurance. Our purpose is to minimise your exposure, reduce your costs, ensure you are fully covered, but not oversold, and simplify the entire experience for you.

Whether you are looking for product liability insurance for a small business or commercial aircraft product liability insurance – we can help you with what you need. So, why should you choose Flycovr for your product and public liability insurance?

Specialisation

We have a background in regulated activities and considerable expertise in the field of aviation supply chain insurance. We understand the complexities of aviation insurance and the needs of our customers; we ensure you have access to the products and services that you need for the smooth running of your business.

Simplification

We have a background in regulated activities and considerable expertise in the field of aviation supply chain insurance. We understand the complexities of aviation insurance and the needs of our customers; we ensure you have access to the products and services that you need for the smooth running of your business.

Fast quotes

Our expedited quotation system means we can get you a personalised quote the same day you contact us. We will connect you with an aviation expert in under an hour, and they will take the time to understand exactly what your insurance needs are before connecting you with a regulated insurance partner.

Binding is available in as fast as 48 hours.

Price transparency

There are no hidden costs. Our aim is to make sure that you have the cover you need at the best price available. We ensure that your insurance products are accurately priced – never overpay for insurance again.

Easy claims process

In the event that you need to make a claim, we have a dedicated claims support team to make the process smooth and painless. Most claims will be settled and paid to you within days or even minutes.

Insurer credibility

We have over 20 years combined experience in aviation products. Our expertise and experience has allowed us to partner with top aviation insurers such as Global Aerospace, USAIG, Starr Aviation, Loadsure, Allianz, Lloyds, and others. We carefully select the appropriate insurer based on your specific insurance requirements so you get the coverage you need.

Post-sale support

We are here with you all the way. If you need information, updates or certificates for customers, we will handle it quickly and at no extra cost. With Flycovr, you have long-term support.

Legal compliance

All of our products are designed to meet FAA, EASA and other international standards for aviation product liability.

Data protection/privacy

We respect your privacy. Your information is only shared with licensed insurers.

Summary

Getting aviation product liability insurance can be complex and time-consuming – our purpose is to simplify the process, make sure you get a quick and accurate quote, and, if required, a fast and fair settlement.

We have access to top aviation underwriters – not typically available to insurance brokers – and we partner with some of the biggest names in the specialised world of aviation insurance.

We know the challenges facing the aviation supply chain, and we have helped hundreds of businesses to get the cost-effective and accurate insurance that they need.

Whether you require a complex international product liability insurance policy or a far simpler one-off policy, we can help you find exactly what you need.

Insurance products tailored to your specific requirements are our speciality; from aviation software, to aircraft parts, or components for drones – your insurance can be customised to suit your business.

For more information, contact us, and we will be happy to help with any aviation product liability insurance questions you might have.

Frequently Asked Questions about Flycovr

Does Flycovr advise on insurance?

No, we are an independent platform and not regulated to advise on insurance by the Financial Conduct Authority. Flycovr acts as an introducer and connects customers with regulated advisers specific to their needs.

What does being “an introducer” mean, and are Flycovr Ltd regulated by the Financial Conduct Authority?

Flycovr Ltd can obtain customer information and provide access to insurance products if the information is deemed suitable for that area of specialism for that regulated insurance adviser.

Under Chapter 5 of The Perimeter Guidance manual, within the FCA Handbook, Flycovr Ltd operates as an introducer or referrer, enabling the provision of information about a potential policyholder to a relevant insurer or an insurance intermediary. Our regulated and specialist broker partners will organise and underwrite all insurance policies. Flycovr Ltd does not provide or underwrite the insurance products purchased.

Who has access to my data?

Flycovr Ltd will have to supply the information provided by you to specialised insurance advisers in order to be able to get you the correct advice required for the desired insurance products.

We will not pass your information onto any other entities other than registered insurance providers within the Flycovr network.

Am I guaranteed a quote?

Risk of rejection is low – an estimated 95% of applicants will receive a quote. We always pre-screen before submitting to ensure you meet the basic eligibility, so as not to waste your time. Aviation product liability insurance is a complex and specialised product, and we want to ensure that you receive the exact insurance for your specific needs.